Learn to Get a Free Credit Score

You want to find out your credit score, but you don’t want to pay for it; find out how to get a free credit score. There are a couple of ways to get a free credit score Most of the methods have strings attached, but if you “avoid” the strings you can get away with a free score.

First, make sure the score you are getting is a FICO score; there are a couple of other scores floating around out there and less than 1% of lenders use them. These scores tend to be a little higher because they use a higher scale. You don’t want to be fooled into thinking you have a good credit score when the score a lender is looking at is much lower. If you have an accurate picture of your credit score whether good or bad, at least you have the same knowledge as the lender. Plus, if it’s bad you have the chance to fix it!

Best Ways to Get a Free Credit Score

Free trials require a credit card before providing your credit score and then charge you automatically at the end of the trial

There are many sites that offer a free credit score if you sign up for a free trial for their credit monitoring service. Usually these sites require a credit card so that they can charge you automatically when the free trial is over. The trick is, and it’s not even a trick because they offer the free trial, but you have to remember to cancel it. They usually make it pretty difficult to cancel it. Signing up only takes a few clicks and entering your information, but cancelling usually requires calling customer service between certain hours and waiting on hold for several minutes before being connected with someone who is trained to do everything possible to keep the subscription. It’s a task; and you can only do it once per site!

Because of backlash over these kinds of sites, some new sites have popped up claiming they are the best way to get a free credit score. These sites boast that you can sign up with no credit card. This is true, you don’t need a credit card, and there is no subscription to cancel. The scores on these sites tend to be kind of inaccurate, and you receive a barrage of credit card offers in your email. These sites also don’t give you a report and the information they have is incomplete.

If you are trying to buy a car or get credit for something else, the salesman running your credit may tell you your score. If you are turned down for credit you are entitled to a free report and many times when you are getting a free report, you are offered a score add-on for around $10.

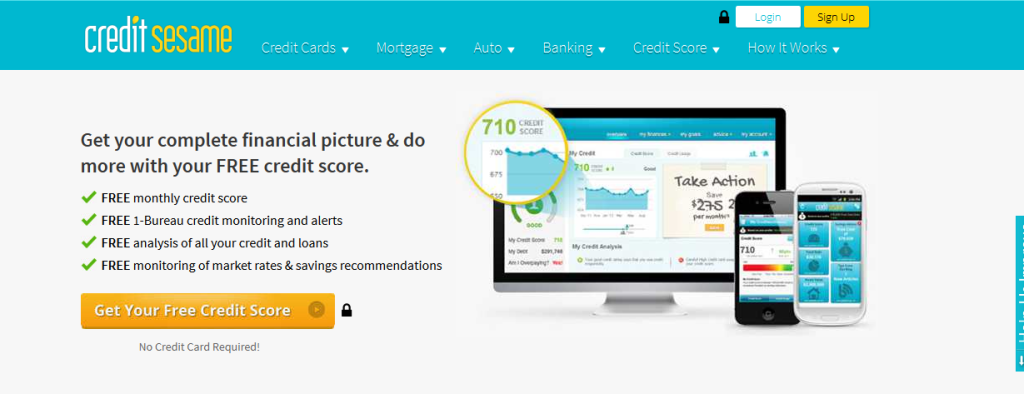

Still wondering how to get a free credit score? There is no surefire way to get an accurate, free, no-strings credit score. There are, however, sites that offer a free credit score, that is accurate, but there are strings; and there are sites that offer a free, no-strings score, that might not be accurate! Even though they are not exact, these scores do land in the range of your score. So if you are curious or just want to find out where your score falls on the credit score scale, check out one of these free sites Credit Karma or Credit Sesame.

Credit Sesame is a free web based tool that helps consumers manage their credit and save money on their loans.

Why Your CREDIT REPORT Matters

Your credit score is an important number, but your credit report contains all the information that you can change to improve your score. A free credit report is available to all Americans every year; visit Annual Credit Report for your free annual 3 bureau report. If you just get your score, you won’t know exactly what’s affecting it.

If you need a very accurate credit score, your best bet is to pay for it with your free annual credit report. One reason you want the score and report from the same bureau at the same time is so that you can see exactly what criteria that company is using to compile that score; one doesn’t really help you much without the other.

If you pay your bills on time and don’t have a mountain of debt, you probably have a pretty good score. If you’re young and you don’t have any credit then you should try to get a low limit credit card, don’t charge more than about 30% of the limit, and pay the whole balance every month. This is a good way to establish your credit for when you’re ready to buy a house. An established credit card is one part of your credit score that you can’t really control later, but don’t take on the extra responsibility if you don’t know how you will pay it and never charge more than you can afford to pay back.

If you’ve had trouble with credit cards or repaying loans and you are ready, willing, and able to clean up your credit, you need all 3 bureau reports. A free credit score without a report can only tell you where you stand.

Speak Your Mind