The Freedom of Living Debt Free – Reasons to Lead a Life of Purpose

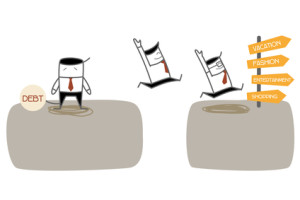

For some debtors, living debt free is a far-fetched dream but for some others it is reality. Self-control, discipline and commitment is what it takes to move away from a life full of debts to one that is free of them. Although you don’t require going through a luxurious life in order to become debt free, the end results are always worth the sacrifice and the pain that it may require. Unlike the debtors, the debt free individuals usually experience fiscal freedom that allows them to enjoy life more fully as they don’t have to be held back or mowed down due to the huge burden of debts. This is certainly a nice place to be at but in order to reach up to this place, you need commitment and determination.

Debt will stress you out – What are you waiting for? Start Living Debt Free

Finding yourself trapped in a cycle of debt can actually seem hopeless but it’s never too late to start off with the steps that will help you get out of debt and start living debt free. How will you devise a plan that will stick to your budget? Your financial plan should help you pin down your motivation for living debt free. Why should you become debt free? Where do you stand when it comes to your mindset about credit card debt? Do you feel that debt isn’t an issue for you or do you feel that paying it off is still not your first priority? Whichever might be the answer for you, there might be valid reasons for this but that doesn’t mean that you will bypass the fact that paying off debt should be the first priority for attaining freedom and prosperity.

High interest debt – Why is it bad for you?

One of the biggest problems with debt, especially the high interest ones is that they bar you from spending your earned money in a way you wish you could spend and further prohibit from living debt free. For instance, you might want to save a portion of your income for retirement or invest to secure the future of your child but when you owe an overwhelming amount on your credit cards, you won’t get the chance to reach your financial goals. On the other hand, when you accrue debt but you’re unable to pay them back, this has a detrimental impact on your credit rating. This can only be avoided when you manage your payments and pay them back on time.

Living debt free – The key to fiscal prosperity

As we’re about to step into 2014, resolve to kick off debt to the curb so that you can gain economic prosperity. You might feel that you still don’t earn enough to seek financial prosperity or that the debt that you carry isn’t impacting your financial future, but despite all this, you should know that the beauty of compound interest means that all you require is setting aside a couple of dollars every month to build a strong emergency fund. If you feel that you don’t need to take any steps towards your soaring debt problems, you can simply use a credit card calculator to know the cost of long term debt.

Smart steps to living debt free – The biggest financial endeavor

If you’re convinced enough that this is the time to become debt free, you should follow certain steps like educating yourself on the things that you can do to pay off debt, making a full-proof plan to optimize your finances and repay your debt and celebrate your success. Make a debt payoff plan that should involve including a budget. Celebrate your success when you reach certain milestones and give yourself a moment to realize that you are now living debt free life for life.

With more cash flow, it is possible to seek financial freedom. You might go on a vacation that you’ve always desired for and thereby fulfilled your wishes. Generate more wealth and follow a if you still incur debt.

Author:

Basij Lorena is a financial writer and a blogger. She has profound knowledge on the different financial issues that are plaguing the current economy and she also offers solutions to the readers through her articles. She contributes her valuable posts to different financial communities, blogs and websites. Some topics covered by her are the US debt and the impact on the economic growth, ways in which debtors should rein in their finances, the pros and cons of consolidating debt and many more. To know more please visit this page.

Speak Your Mind