Managing your Finances with the Inverted Pyramid Model

Managing finances is a skill that takes time and experience to master, no matter how much money you have in your account. In truth, it does not take a financial genius to manage your finance. Making them grow is another story but budgeting what is available is simple, although it is easier said than done. Budgeting ultimately boils down to differentiating wants and needs. Moreover, prioritize needs over wants.

One of the most popular budgeting rules is the 50/30/20 – 50 % for utilities, 30% for luxuries and 20% for monthly savings. This ratio does not have to be followed strictly but it gives you a picture of how much money should ideally to go to a specific part of your spending. More frugal people can even allot 30% for savings and 20% for luxuries.

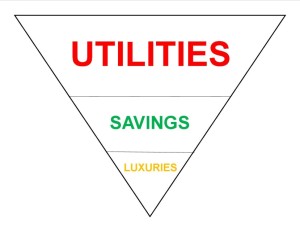

A complementary strategy to employ with this ratio is the inverted pyramid. The inverted pyramid model is a figure popularly employed in various fields of study, most notably journalism. A journalist, when making a report, prioritizes the most important information by putting them at the first part of the report, before filling in all the details in the subsequent parts. The same principle can be very effective if you want to manage your finance well.

The inverted pyramid above shows the utilities at the topmost portion, signifying that these should be given top priority. Pay off all your utilities first because they are your needs. For most, this should comprise 50% of your budget.

The ratio given earlier allots 30% for luxuries and 20% for savings. The ratio is really up to individual preferences, but this author believes that savings should be prioritized over luxuries. Luxuries change from time to time. More often than not, the cost for luxuries is not fixed. If you put luxuries before savings, chances are you will end up not saving anything. TO manage your finances well, set aside money for your savings first after you finish paying all your utilities.

Keep the inverted pyramid model in mind when you manage your finances every pay period, even down to the rudiments of actual spending. One blogger shares her tip in saving on grocery expenses using the similar principle: “I refer to it as the “upside down triangle method” because you start by planning your biggest meals first and use the rest to make up other meals.” By biggest meals, she means dinners where bigger groups of people are involved. For example, if you have a dinner planned with your family or friends, you should plan the menu for that. Your regular daily meals can be planned by the left-over ingredients from your big meals. If you’re cooking seafood paella for a family dinner on Saturday, some of your weeknight meals can be based on the left over shrimp or mussels from the seafood paella.

The beauty of adhering to the inverted pyramid model to manage your finances is that it harmonizes with the ideal needs and wants balance. Pay all of your bills first, and at once to get them out of the way. Delaying payment of utilities will result to annoying penalty charges that accumulate to what could be big savings. By prioritizing savings over luxuries, you will secure yourself with funds if an emergency arises.

The inverted pyramid model will assist you in managing your finances more efficiently, even if you assign a ratio that’s different from the one used above.

A guest post by Cristina Beltran

Speak Your Mind